Alpha Trading Desk (2013 HK pro) is a trading suite designed for sophisticated investors/investment professionals. Not only providing common asset information such as real-time stock price, the Portfolio core module provides the portfolio overview such as portfolio expected return, daily profit/loss. Further, ATD also provides the risk control information, such as asset expected return, asset risk, portfolio risk, Value at Risk (VaR) and Conditional Value at Risk (CVaR).

Features:

•Real-Time portfolio: portfolio value, daily return.

•Price alert: Cut-loss price and target price

•Portfolio risk indicators: Risk, VaR, CVaR

•Asset correlation efficiencies charts

•Asset category weighting charts

The package supported by add-on modules:

Bull-Eye Search

It is our popular top performance stocks/mutual funds search engine, which allows users rapidly search and spot top performance assets in seconds by their targeted return, historical return, risk, Sharpe ratio, Alpha and Beta with filter options of asset class, capital size and sector.

Features:

•Asset performance histories: 1-year, 3-year and 5-year

•Search filters of asset class, market capital size, asset category

•Finance indicators: Return, Risk, Sharpe ratio

•Assets Benchmark KPIs: Beta, Alpha, R-Square

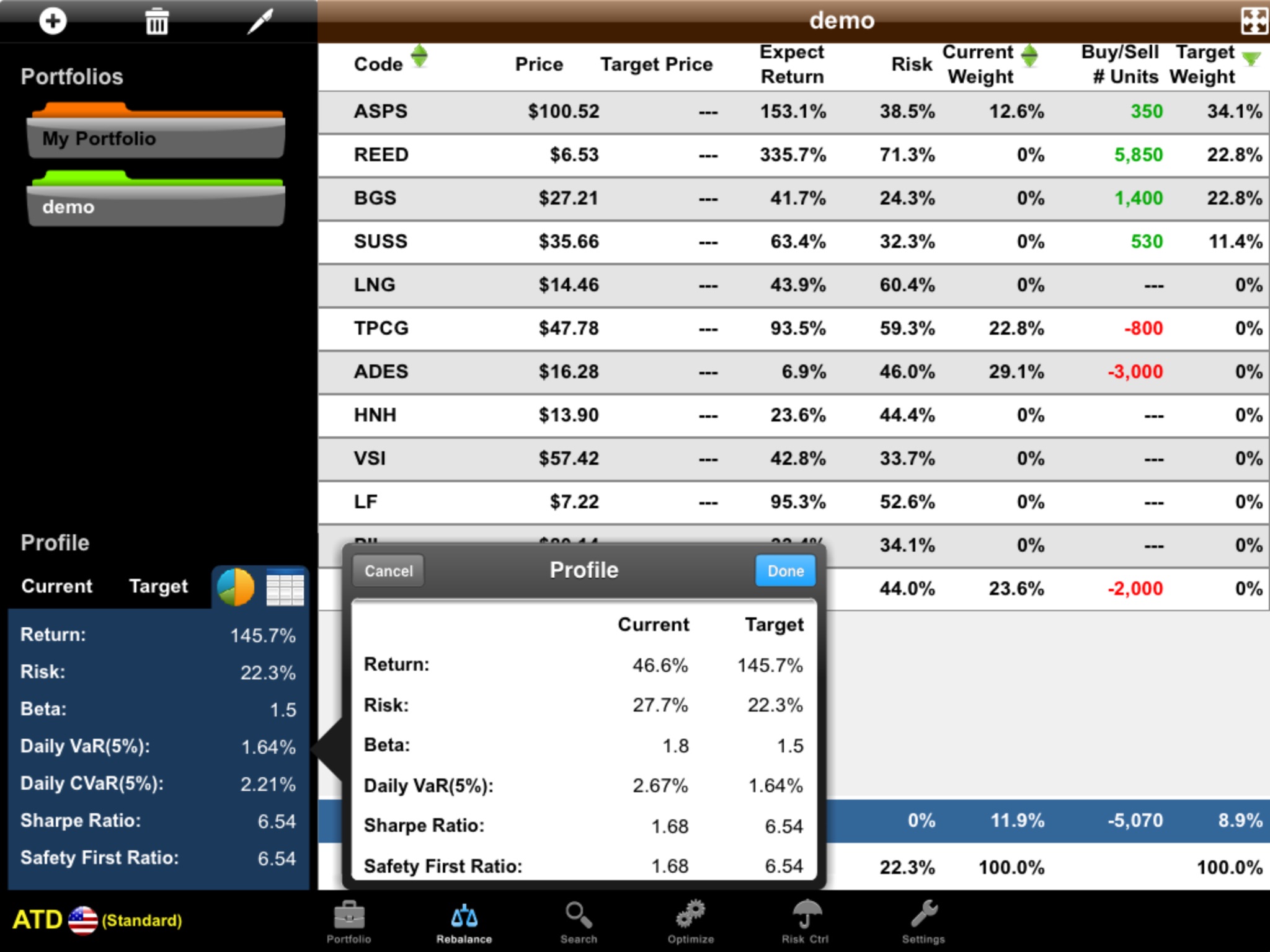

Portfolio Re-Balancer

It is professional grade tools which keeps portfolios from deviating away from their original target asset allocations. The potential benefits of portfolio rebalance include return enhancement and risk control. This module provides comparison indicators and charts between current portfolio and the targeted portfolio, such as return, risk, Sharpe Ratio, Value at Risk and stock category overview. Further, asset correlation efficiencies among assets are provided for visual inspection.

Features:

•Real-Time current asset weightings

•Chart: Current asset category Vs Target asset category

•KPIs: Current portfolio Vs Target portfolio (Return, Risk, CVaR etc...)

•Auto order suggestions for portfolio rebalancing

Risk Controller

The risk Controller is a simple and intuitive tool. Using PRC, investors can have a complete risk profile of their investment and control in the risk exposures of their portfolios. Users have options to use either Sharpe ratio or Sortino ratio as risk control KPIs to suit their needs.

Features:

•Choice of standard risk or Downside risk

•Slide bar for portfolio: Risk, Roy’s safety first ratio

•Target portfolio KPIs: Return, Risk, Sharpe ratio, Sortina ratio, CVaR

Portfolio Optimizer

The Portfolio Optimizer is the core module of our flagship product Quantitative Portfolio Optimizer. It optimizes your portfolio by giving the optimal portfolio with assets weightings. Two optimization modes comes as standard. The Selected Mode optimized portfolio give the maximum Sharpe Ratio which may select only a handful of assets from the existing portfolio. The Full Mode optimized portfolio return an optimized portfolio which includes all assets.

Features:

•Choice of optimization mode: Selected or full

•Slide bar for portfolio adjustment: Risk free rate, Risk, Roy’s safety first ratio

•Target portfolio KPIs: Return, Risk, Sharpe ratio, Sortina ratio, CVaR

•Target portfolio asset category distribution

•Target portfolio return distribution (VaR and CVaR)

Backtester

The Backtester enables users to backtest the portfolios for comparison

Features:

•Choice of duration: 1-year, 2-year and 3-year

•Line chart Portfolios 1) Original 2) Buy-and-Hold 3) Constant-Mix

*** This professional version includes 2014 data services and handles up to 5 Portfolio with each up to 16 assets ***